The Focus - Our Tax E-Newsletter |

Hurtling Towards the Fiscal Cliff

James Bond is back in the movie theaters celebrating fifty years of action adventure. Being a long time skier, one of my favorite opening sequences is from The Spy Who Loved Me. Agent 007 escapes enemy agents by skiing and shooting his way down a perilous mountain. As the sequence nears its climax the camera pans back and you see that Mr. Bond is heading for a precipice and certain doom. As he goes over the cliff there is a moment of silence, his skis fall off and, miraculously, a parachute boldly in the image of the Union Jack opens and the familiar opening blare of music signals yet another escape from certain death. Sitting in the movie theater you knew that he would be safe – after all there was two more hours of entertainment still to come.

Right now the country is approaching the much discussed fiscal cliff. The recent election at least defined the cast of characters that will be involved. With the reelection of President Obama, the Senate remaining in the hands of the Democrats and the House staying with the Republicans this is looking a bit like a sequel from two years ago. There is a lot of speculation as to what may happen but we should start with what we know right now. The Federal Government faces a looming debt limit and when it is reached the deal from two years ago calls for automatic across-the-board spending cuts. The provisions of the Affordable Care Act (ACA) will continue to phase in over the next several years having a significant impact on employers and high income taxpayers. We also know that the Alternative Minimum Tax increased dramatically last January 1st and is slotted to affect twenty million unsuspecting taxpayers according to the Internal Revenue Service.

Let’s take a hypothetical example to illustrate the impact of the dilemma facing taxpayers today. Our example taxpayers are a married couple, one with wages of $200,000 and the other earning $50,000. They have done well saving and investing and have interest income of $5,000 annually, qualified dividends of $7,500 and capital gains of $10,000 a year. Our enterprising couple has two children, pay roughly $17,000 in state income taxes and $10,000 in property taxes each year. They pay $5,000 in mortgage interest and donate $6,000 a year to charity.

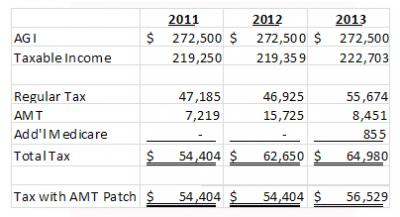

For 2012 the change is made up entirely from the AMT patch. For 2013, under the current law the change is primarily from increased rates and the loss of itemized deductions and personal exemptions. The AMT patch affects our taxpayers in 2013 but not to the extent of 2012 because of the higher normal rates.

The 2013 calculation reflects increased rates on dividend income and the impact of the ACA on investment income.

Taxpayers in significantly lower brackets will be affected by the lack of a patch as it is caused as much by low tax rates and normal personal exemptions when compared to the AMT system. For example take a married couple earning $90,000 in 2012. With a standard deduction and two exemptions taxable income is $70,500. The first $17,400 is taxed at 10% with the balance taxed at 15% for a total tax bill of $9,705. In AMT the 90,000 is reduced by the $45,000 exemption and then taxed at 26% for an AMT of $11,700 -- $1,995 above the regular tax rate. I don’t think Congress anticipated that result but that is the reality for 2012 unless Congress and the President act quickly. Acting IRS Commissioner Steven Miller has ordered his programmers to leave intact the larger exemption amount and informed Congress that changing the exemption would lead to significant delays in processing returns in 2013 filing season. He is placing his bet that Congress will act.

What should you do to try to plan around AMT or even further into next year to avoid some of the deleterious effects of expected changes? You really need to develop a game plan. Talk to your advisors and do the math. Acting in haste may result in repentance in leisure. To the extent that you can accelerate income into 2012 this may be the year to do it. Look at your investment portfolio and see if it makes sense to sell at the lower current rates. The market certainly reacted that way right after the November election. If you own a closely held company, particularly an S Corporation that has prior C Corporation earnings you may want to consider deeming 2012 distributions as taxable C Corp dividends. The lifetime gifting limit is $5.12 million this year scheduled to drop to $1 million next year. Any transfer of significant assets should involve a good estate attorney along with your accountant familiar with your circumstance. I would recommend that you go to our website at www.dbbllc.com to review the year-end tax planning guide and some of the articles that are already there.

What will happen next year? I don’t like to predict the future, especially in the current political climate. There is an old adage that “he who lives by the crystal ball, dies from eating broken glass”. The President talks about keeping the rates the same for taxpayers making less than $250,000. The Republicans talk of keeping rates the same and reducing loopholes. I think the notion of AMT already accomplishes that goal without trying too hard. The President is not likely to let go of his ACA achievement so it is likely that those surcharges will survive into the future.

If nothing happens between now and January then we do know that peoples paychecks will be affected starting in January. Tax rates will increase and the 2% payroll tax holiday goes away. It is likely some legislative compromise will be reached. We will keep a close eye on developments in Washington and inform you of them as they occur. I think that I can safely predict, without the risk of eating broken glass that change will happen and taxes will be ever more complicated.

As always please contact your Dermody, Burke & Brown tax advisor if you would like to discuss this further or if you have any questions.

The information reflected in this article was current at the time of publication. This information will not be modified or updated for any subsequent tax law changes, if any.